|

Image: grocerytrader / FIS

Lidl remains fastest growing grocery retailer as food inflation accelerates

UNITED KINGDOM

UNITED KINGDOM

Tuesday, September 27, 2022, 07:00 (GMT + 9)

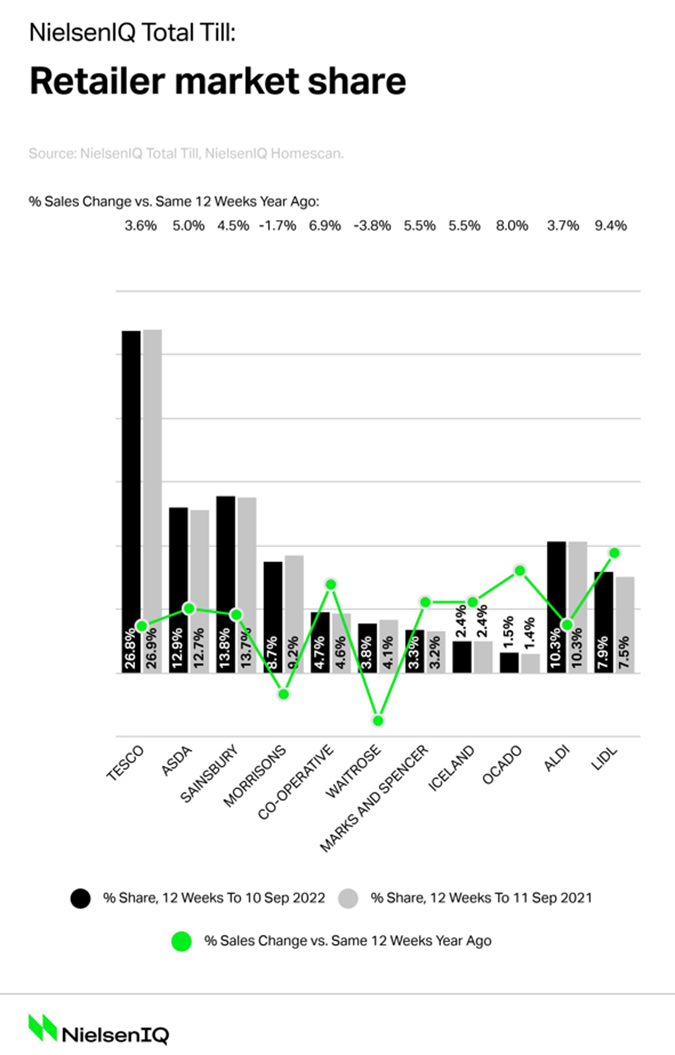

Total Till sales growth slowed from +4.5% last month to +2.5% in the last four weeks ending 10th September as shoppers returned from holidays and reset spending patterns

- Lidl (+9.4%) remains the fastest growing grocery retailer in the last 12 weeks as UK shoppers focus on buying little and more often to help manage rising food bills

- Online grocery sales fall 7% and there are 1 million fewer online deliveries than this time last year

Lidl remains the fastest growing retailer in the last 12 weeks ending 10th September, as food inflation accelerates and UK shoppers focus on buying little and more often to help manage rising food bills, reveals new data released today by NielsenIQ. Lidl remains the fastest growing retailer in the last 12 weeks ending 10th September, as food inflation accelerates and UK shoppers focus on buying little and more often to help manage rising food bills, reveals new data released today by NielsenIQ.

Data from NielsenIQ reveals that Total Till sales growth slowed from +4.5% the previous month to +2.5% in the last four weeks ending 10th September, as shoppers returned from holidays, returned to work and reset their spending patterns after the summer.

UK shoppers rein in spend ahead of autumn

NielsenIQ data shows that sales at the Grocery Multiples (supermarkets) during the week ending 10th September dipped to £2.48bn1, which is the lowest level this year since the lull in the week after Easter 2022. To put this into context, for the 4 week period this is £400m less being spent at supermarkets as shoppers rein in spend at the start of autumn2.

Moreover, with the cost of household bills surging, NielsenIQ records that volumes are down -4.4% at the Grocery Multiples over the last 12 weeks.

Promotional spend also continues to flatline, accounting for just 20.9% of all sales, this is a slight increase from 19.9% last year.

.png)

Online sales continue to fall

According to data from NielsenIQ, visits to stores increased by +4.8% in the last 4 weeks, while online visits declined by 5.3%. This equates to 1 million fewer online deliveries than this time last year. As a result, online sales fell 7% compared with the same period last year.

NielsenIQ data also shows that the online share of FMCG sales has declined to 11.1% – this is down from 11.3% recorded last month and down from 12.3% a year ago. This decrease may indicate that this is now approaching the normal level for online share.

Category growths driven by inflation

Pet & petcare was the fastest growing category over the four weeks with value growth of +12.7%. Meanwhile, there was also strong value growth in soft drinks (+11.0%). This category was also the only FMCG category to see volume growth (+4.5%). However, food inflation continues to lift value growth in dairy (+9.3%) and bakery products (+6.9%). There were value sales declines across beers, wines and spirits (-4.5%), fresh produce (-2.3%), and confectionery (-2.0%).

Asda becomes one of the fastest growing retailers

In terms of retailer performance, Lidl (+9.4%) remains the fastest growing grocery retailer over the last 12 weeks, closely followed by the Co-operative (+6.9%), Marks & Spencer (5.5%) and Iceland (5.5%). Asda (5.0%) was the fastest growing retailer in the ‘big 4 supermarkets’ while sales at Morrisons and Waitrose continue to fall.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “Asda sales have rebounded strongly in recent weeks helped by weak year ago sales, but the retailer has also been attracting new shoppers. This suggests that new range initiatives such as Just Essentials and the roll out of Asda Rewards are giving a stronger price perception and now starting to have an impact on sales.” Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “Asda sales have rebounded strongly in recent weeks helped by weak year ago sales, but the retailer has also been attracting new shoppers. This suggests that new range initiatives such as Just Essentials and the roll out of Asda Rewards are giving a stronger price perception and now starting to have an impact on sales.”

Watkins continues: “With food prices continuing to rise and household energy costs about to jump in October, it’s no surprise that our data shows that 57%3 of consumers are saying they have been severely or moderately affected by the cost of living crisis, and in three months this is anticipated to rise to 76%. With CPI inflation expected to remain close to current levels for the rest of the year, this will encourage households to shop around and to look for savings across different retailers, with shoppers increasingly focussing on the cost of their weekly groceries to help manage personal finances".

Source: grocerytrader.co.uk

editorial@seafood.media

www.seafood.media

|